Guidelines for Transfer Pricing related interests & spreads applied in Zero Balancing Cash Pools – Part 1

Executive summary A Zero Balancing structure mirrors the core activity of a bank. Therefore, managing a Zero Balance Account (ZBA) structure requires a corporate treasury to operate an In-House Bank. This In-House Bank must apply Arms-Length interest to balances in its In-House Bank accounts as well as to InterCompany Lending and Depositing/Investing, both debit and credit. To comply with OECD BEPS Transfer Pricing regulations, Arms-length must adhere to the logical spread similar to that used in core banking operations. This entails ensuring that the spread on current account interest (debit/credit) are further from the reference rate than the spread on InterCompany Lending/Depositing. This white paper discusses, in two parts, the background and guidelines of setting Transfer Pricing related interest spreads in Zero Balancing Cash Pools. Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to TreasuryMastermind.com. Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! PART 1 Many companies are considering or have already adopted Zero Balancing Cash Pools structures to optimize working capital and operating cash. The beauty of Zero Balancing Cash Pools lies in the ability to prevent idle cash from sitting at the operating unit, and automatically funding operating units with cash needs. Consequently, the cash pool leader (often the central Treasury) can manage idle cash centrally while efficiently funding working capital needs. It is essential to emphasize that cash in a Zero Balancing structure is operating cash,representing short term working capital. In this white paper part 1, the importance of setting the right interest rates (both debit and credit) for Zero Balancing structures will be explained; Part 2 discusses the appropriate level of interest spreads to meet OECD BEPS Transfer Pricing guidelines. To come to this, it’s necessary to explain the basics of banking and how they relate to Zero Balancing structures. Core banking explained The primary function of a commercial bank is to attract money from those who have surplus cash and subsequently use those funds to finance those who need money. Banks offer unique bank account numbers where you can deposit money or borrow from (overdrawing a bank account). The bank compensates idle cash with credit interest, usually lower than the “fee” for borrowed money (debit interest). The difference between credit interest and debit interest forms the primary business model of commercial bank. Bank operate on the legal premise that every penny in a bank account is legally owned by the bank; thus, deposited money becomes the bank’s property; It is legally not your money anymore. Effectively you transfer ownership of your money to the bank. This allows banks to redistribute funds by lending them out, as the money in the bank account is legally considered a liability to the account holder. Consequently, every account holder with “surplus cash” in the bank account must regard this as a loan to the bank and an asset on their balance sheet. Obviously, you can freely tap on this asset when needed (e.g. for making payments, etc.). Vice versa, an overdrawn bank account is effectively money that the bank is lending to you and is therefore a liability on your balance sheet. I am using the words “lending to/from the bank” as this is an important subject for tax authorities. I will come back to that later in this white paper (see “Commercial bank interest versus In-House Bank interest”). Understanding the legal aspects of bank accounts explains why the core business model of banks can exist and why depositors may incur losses if a bank faces financial trouble, and eventually files for Chapter 11. Core banking mechanism versus In-House Bank mechanism The business model of a bank elucidates the legal aspects of Zero Balancing structures, as these structure mimics core banking mechanisms. In a ZBA structure, excess cash is legally transferred to the cash pool leader, and overdrawn bank accounts are funded by the cash pool leader. This ensures that all participating bank accounts start each day with a “fresh” Zero Balance, allowing the cash pool leader optimal access to the company’s operating cash. The ZBA structure, by mimicing the core banking mechanism, designates the Cash Pool leader as the “In-House Bank”. Below diagram shows the basics of a ZBA structure where Operating unit A has a cash balance of 500 and Operating unit B has an overdrawn balance of -100. At End-Of-Day, after the ZBA sweeps have been applied, the balances of all Operating Units are zero and the net cash balance of 400 sits with the cash pool leader. Zero-Balancing sweeps and the In-House Bank By default, a Cash Pool leader (referred to asthe In-House Bank) possesses the cash of the participating operating units. However, each sweep between the master account of the Cash Pool Leader and the accounts of Operating units will create either a Liability (credit sweep) or an Asset (debit sweep) for the In-House Bank. This is because the In-House Bank mimics the core banking mechanism. Consequently, the In-House Bank must record all these ZBA sweeps to track accumulated balances per Operating Unit over time. Each sweep must be registered at a unique identifier linked to the operating bank account so that both the In-House Bank as well as the owner of the operating bank account can determine the net transferred balance over time. This unique identifier is often referred to as the “In House Bank account”. Thus, a USD 500 balance in an operating account will be swept at the end of the day to the master account of the In-House Bank, simultaneously recorded as a USD 500 liability in the unique In-House Bank account. Therefore, the bank account of the operating unit must logically be linked to the unique In-House Bank account. It is akin to transferring the End-Of-Day operating balance to “Savings” account with the In-House Bank. In the…

The Importance of Data for Treasurers: Embracing the Era of “Treasury on-Demand”

In the rapidly changing landscape of finance, treasurers face a need for real-time information and efficient decision-making. To meet this demand, the concept of “treasury on-demand” has emerged, making it necessary for treasurers to dematerialize and digitize their operations to enhance resilience. In this digital era, data has become the lifeblood of effective treasury management, making it essential for treasurers to adopt a data-driven mindset and prioritize the quality and utilization of data over technology alone. Building a Strong Data Foundation for Treasury on Demand Treasurers must recognize that strong data serves as their best line of defense against risk. Traditional, low-tech treasury practices pose significant risks to any company, as they are prone to errors and lack the agility needed to navigate today’s complex financial landscape. The digital transformation of treasury operations is vital, as it enables treasurers to free themselves from mechanical and repetitive tasks while minimizing the potential for mistakes. The key to achieving this lies in intelligent automation, which streamlines processes and enhances efficiency, ultimately empowering treasurers to make more informed decisions. Data: The Core Element of Digital Transformation In the pursuit of digital transformation, it is crucial to understand that data takes precedence over technology. Although technology plays an integral role in scaling and utilizing data effectively, the quality of the data itself acts as the foundation, often referred to as the “digital asset.” Many companies mistakenly place excessive reliance on technology, erroneously assuming it to be the primary driver of success. However, true success lies in the ability to comprehend and communicate about data. Data literacy is rapidly becoming a vital skill in the 21st-century, enabling individuals to ask the right questions and actively participate in data-driven conversations. Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to TreasuryMastermind.com. Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! The Value of Data and Effective Decision-Making Data holds immense value only when accompanied by actionable insights. Before harnessing data to solve problems and make informed decisions, it is crucial to fully comprehend the underlying issues. Then explore how data can provide solutions. However, it is equally important to differentiate between the data that can be obtained and the data that is truly valuable. Wasting time and resources collecting irrelevant data hampers progress. To avoid this trap, treasurers should consistently ask themselves, “If I had the data, what could I do?”. This question helps focus efforts on acquiring the most meaningful and impactful data. Fostering Data Literacy and a Data-Driven Mindset Organizations today are inundated with data, evident in the proliferation of reports and dashboards. To navigate this data-rich environment, treasurers must evangelize and champion data literacy throughout their organizations. Data literacy empowers individuals to interpret and communicate insights effectively. This enables them to leverage data as the world’s most valuable asset, as proclaimed by The Economist. Embracing powerful analytics and data mining as essential skills facilitates a better understanding and utilization of data. Helping treasurers extract meaningful insights and drive positive business outcomes. Unlocking the Potential of APIs and Real-Time Data Exchange While many treasuries still rely on scheduled, file-based systems for data exchange, the emergence of APIs offers a transformative solution. APIs enable seamless data exchange between software applications in real time. It eliminates the need for scheduling and provides treasurers with immediate access to critical information. Embracing APIs and real-time data exchange enhances the agility and responsiveness of Treasury operations. Thus enabling treasurers to make informed decisions quickly and efficiently. Leveraging Data for Growth and Performance In the pursuit of data-driven treasury management, the ultimate goal is not simply to extract as much data as possible. But rather to leverage data strategically to drive growth. To reduce waste, enhance customer satisfaction, and improve overall company performance. Effective data utilization requires treasurers to adopt a storytelling approach, transforming data facts into actionable insights that resonate with stakeholders. By effectively communicating the value derived from data, treasurers can drive organizational buy-in and foster a culture of data-driven decision-making. Treasurers must recognize the significance of data as they navigate the evolving financial landscape. Embracing a data-driven mindset, prioritizing the quality of data, and leveraging technological advancements such as APIs and analytics are essential steps towards achieving real-time treasury operations. By harnessing the power of data, treasurers can empower their organizations. They can also enhance decision-making, and drive long-term success in the digital age. In summary, embracing “treasury on demand” necessitates prioritizing data, fostering data literacy, and leveraging technological advancements to achieve real-time treasury operations. By doing so, treasurers can navigate the evolving financial landscape with agility and resilience. RELATED TO TREASURY ON DEMAND

How to Start a Discussion on the Forum

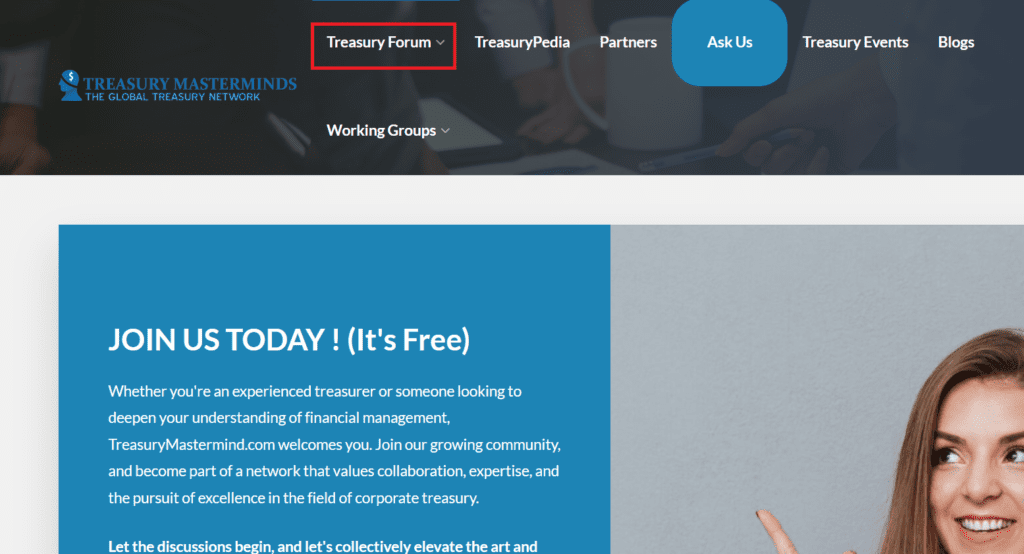

At the heart of our community lies a commitment to fostering a diverse and inclusive environment. Whether you’re a seasoned expert with years of experience under your belt or a newcomer eager to learn the ropes, your voice matters. Each member brings a unique perspective to the table, enriching our discussions and expanding our collective knowledge base. Our community is built on the belief that collaboration breeds success. We understand that no single individual has all the answers, which is why we encourage active participation and engagement from all members. Whether you have a burning question that needs answering, an exciting opportunity to explore, or an innovative idea to share, our community is here to support you every step of the way. One of the greatest assets of our community is the wealth of knowledge and experience that our members bring to the table. From navigating complex financial regulations to implementing cutting-edge technologies, there’s no shortage of expertise within our ranks. By sharing our insights and best practices, we empower each other to overcome challenges and seize new opportunities. Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to TreasuryMastermind.com. Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! How to start a discussion To start a discussion on the forum, please follow these steps: Step 1: First, ensure you are a registered member and logged in, then click on the “Treasury Forum” menu at the top right and a drop-down menu will appear. Step 2: When the drop-down menu comes up, click on “Forums” to go to the forums section. Step 3: On the “Forums” page, click on any of the forums that is related to what you want to share or you can click on “View all” to view all the forums. Step 4: Once you have been directed to your selected forum, scroll down to where you can “Create a new topic” and add the topic of your discussion. Step 5: Then add the body of text to your discussion. You can also add an image (this is optional). Step 6: You can Add words which are related to your discussion, known as topic tags (this is also optional) Step 7: Then ensure the “Topic Type” is set to to “Normal” and the “Topic Status” is set to “Open.” Step 8: Then check “Notify me of follow-up replies via email” to keep track of further replies to your discussion via your email. Step 9: Finally, click on “Submit” when you are done. So there you have it. We invite you to embrace this exciting new feature. Whether you’re a seasoned veteran or a newcomer to our forum, there’s never been a better time to connect, collaborate, and thrive within our community.

Embedded Finance to Embedded Treasury: Are Corporates Ready for the Transition?

This article is written by Kyriba Embedded finance is the practice of integrating financial services within non-financial platforms and services with the objective of delivering the financial service at the “point of need.” In the not-so-distant past, accessing financial services such as payments, lending, and investments required either a visit to the bank or a redirection to a financial services provider’s portal or call center. Software platforms, software enablers, and banks are driving digital transformation, seamlessly integrating financial services, or ’embedding’ them, into non-financial services contexts. This revolutionizes how financial services are delivered and consumed. Payments are the most prominent of all embedded financial use cases for customers. Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to TreasuryMastermind.com. Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! The Rise of Embedded Finance in B2B Context Embedded finance and, by extension, embedded payments are commonly talked about in the context of consumers. However, they are increasingly gaining prominence within the B2B context. According to 2021 estimates from Bain, B2B payment volumes amount to $27.5 trillion, with Accounts Payable and Accounts Receivable representing 90% of the value. This volume is expected to reach $33.3 trillion by 2026. Embedded payments account for a low single-digit share of B2B payment volumes. B2B embedded payments are expected to quadruple from $0.7 trillion (2.5% share) in 2021 to $2.6 trillion in volume (7.8% share) in 2026. ACH accounts for the majority of embedded payment volumes, with a small fraction coming from cards. This transition is becoming increasingly possible with the rise of open banking and APIs that enable the seamless embedding of financial services in business systems and processes. Before APIs, embedding financial services directly within existing business processes was complex. For instance, embedding payments from one bank into a business’s ERP could take anywhere from 6–8 months or longer. This long time-to-market was a result of many complexities (e.g., multiple ERPs, customizations, need for specialized resources or lack thereof). The onboarding time and investment required to embed financial services often outweighed the benefits. This was even more complicated for mid-market and enterprise businesses with multi-bank relationships. ALSO READ The Role of Software Enablers in Enabling Embedded Experiences The rise of software enablers utilizing the Software-as-a-Service (SaaS) model has been critical to delivering embedded experiences. These embedded finance solutions began by enabling payments and other financial services into business processes using host-to-host connections, diminishing the role of traditional bank portals. To enable truly embedded experiences, APIs are increasingly becoming available from banks and software enablers. Banks in the US and other geographies have made significant investments in APIs. In Europe, regulations such as PSD2 have aided this transition, while in the US, it has been market-driven. Banks’ motivations include reducing complexity, improving agility, enabling partners, ensuring regulatory compliance, and driving innovation. Over 75% of these APIs are for internal use, with the remainder intended for distribution purposes via partners or developers. Partners act as enablers, saving corporations time and effort in dealing with disparate API integrations across banks. Corporations empower themselves to automate downstream treasury or other non-treasury business processes. This is in alignment with the organization’s operational goals by seamlessly accessing multiple bank APIs via partners. Banks’ Investments in APIs Consider a scenario where a treasurer and a Treasury payment analyst discuss an urgent payment to a counterparty. They use their organization’s internal messaging platform (e.g., Microsoft Teams). Traditionally, this would require the analyst to access another system. For example, a bank portal or TMS would initiate, approve, and release the payment. The power of open APIs enables such requests to originate. And be approved, and released within the context of the messaging system. Providing real-time visibility into the account’s beginning and ending balance. There is no reason to switch contexts. Treasury professionals can securely execute the entire process within the context of the messages exchanged. This example captures the essence of embedded finance as payments. Financial services deliver efficiently and seamlessly at the point of need, i.e., through a conversation over a corporate messaging platform. APIs can also act as catalysts for upstream or downstream process / system modernization. For instance, an existing system (e.g., a web portal) may be supporting a slow FTP-based legacy process. You can modernize managing intercompany loans without needing to rip and replace the entire system. With APIs, the same system can process real-time requests for intercompany loans. And stay in sync with the treasury management system. Embedded Finance to Embedded Treasury The rise of embedded finance and the adoption of APIs have transformed how financial services are delivered and consumed. Businesses can now seamlessly integrate financial services into their existing systems and processes. With the help of software enablers and banks. This improves efficiency and reduces complexity. Those that embrace this trend are likely to enjoy a significant advantage in the years to come. Corporates should consider adding APIs to their transformation strategy and should proactively speak with their bank / provider. In order to explore the possibilities.

OECD BEPS and Transfer Pricing: Differentiating In-House Bank Interest Depending on Balance Sheet

When companies set up a Zero Balancing Cash Pools structures, tax authorities scrutinize in-house bank solutions and apply interest spreads. To support this, a number of countries are working together through the OECD organization. They aim to streamline economic market forces and have defined guidelines accordingly. This measure aims to prevent tax base erosion and profit shifting resulting from non-realistic spreads applied in in-house bank structures. The guidelines are known as OECD BEPS. Understanding OECD BEPS Guidelines In short, the OECD BEPS guidelines specify that in-house banks must provide solid and realistic justification for the spreads they apply. In addition, local tax authorities may interpret a solid and realistic substantiation of the applied spread differently. This interpretation suggests that spreads should differ per legal operating entity. It is akin to how external commercial banks assess terms and conditions for customers legal operating entities individually. Challenges and Solutions Corporate Treasury and Tax departments tend to “keep things simple.” This is because of the workload involved when differentiating interest spread per operating entity. Interest spreads on InterCompany loans are rather easy to differentiate as: Compliance and Documentation This may potentially be sustainable for companies with little history of cash pool structures. However, for mature companies, there is an increased tendency for local tax authorities to scrutinize in-house bank structures. They aim to understand whether interest spread settings comply with OECD BEPS Transfer Pricing guidelines. To further comply with transfer pricing principles, with an increased focus on OECD BEPS, more companies are implementing methodologies. These methodologies aim to differentiate interest spreads based on the individual balance sheets of legal entities. Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to TreasuryMastermind.com. Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! Preparedness for Tax Authority Reviews External banks run a risk analysis for each company that wants to bank with them and is additionally looking for financing (part of the Know Your Customer requirements). Similar to external commercial banks, an in-house bank may be required to apply larger spreads for legal entities that have a financially stable balance sheet. Assessing each individual operating unit and applying a separate risk related interest spread can be too labor intensive and counterproductive. A more practical and accepted approach to this is to introduce a limited number of “risk” classes, e.g., A-level means a healthy financial balance sheet, B-level means the balance sheet is on the watch, and C-level is technically bankrupt. In-house bank spreads will need to be differentiated according to risk classes. Periodically, e.g., once a year, legal entities are reviewed to reassess the risk class (and potentially apply a renewed interest spread). In Conclusion… Any risk class review and assessment will be required to be documented. The better the documentation (including the rationale behind the applied interest spread), the more likely it is that local tax authorities will be less inclined to scrutinize legal entities. Documenting the rationale behind interest spreads and the review methodology can be included in the cash management agreement. (See white paper “Legal Aspects of In-House Banking” 2024, March Maarten Steyerberg, Solutius.). Many treasury management systems will be able to support this approach. When an operating entity or the in-house bank is under review by the local tax authorities, Treasury and Tax will need to be prepared to provide answers on why the current methodology for interest spreads has been applied and how that matches transfer pricing principles. The better the rationale behind the current methodology is explained and documented, the fewer discussions are expected with local tax authorities and, therefore, fewer tax consequences. Paul Buck is a Treasury Associate with one of our partners, Percunia Treasury and Finance and is available for any project. Fill out the contact form below to get in touch for more information about Paul and his capabilities. Thanks! Notice: JavaScript is required for this content.

A deep dive: Simplifying guarantee management for treasury & finance

This article is written by Nomentia Treasurers have a love-hate relationship with guarantees. While they are usually not a big concern as long as there are few, managing hundreds or even thousands of various types of guarantees across different entities, guarantors, beneficiaries, countries, and therefore languages and jurisdictions can be a nightmare, especially without the right tools. Below, we provide insights into what managing guarantees actually means, what the challenges are when doing so and why doing it right equals less time spent and money saved. In the second part of this post, we provide an overview of the capabilities that modern, digital guarantee management solutions offer and their benefits. JOIN OUR FORUM TODATY! Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to Treasurymastermind.com Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury. Let’s initiate discussions and together elevate the art and science of treasury management! Why guarantees matter Guarantees facilitate trade by assuring the buyers/project owners (“beneficiaries”) that the guarantor, usually a bank or (credit) insurance company – will uphold a contract in case the seller/contractor (“the applicant” to the guarantee) is unable to do so. They are therefore a vital tool heavily used across sectors as varied as construction, facility management, manufacturing, and retail and across the different stages of a business transaction, from bidding for a project, the delivery of the goods or performance of the services to ensuring pre-agreed services during the warranty period. By committing to paying the agreed amount upon first demand by the buyer, the guarantor (usually a bank or credit insurer) assumes risk. Compensation for this risk is in the form of various guarantee-related fees. Also, guarantors usually only agree to assume a pre-defined amount of risk for any given company in the form of a pre-agreed guarantee facility. Against this background, it is obvious that managing large portfolios can be a challenge. Not only is the timely processing of guarantees from various facilities agreed upon with various banks, but sometimes hundreds, if not thousands, of different types of guarantees can be challenging. What is guarantee management? Guarantee management means the management of all guarantees for a company. A guarantee itself is a way of showing a counterparty that you are a secure contracting party. The guarantee is set up with a third party, most often a bank. The bank acts as a mediator and becomes the guarantor as the guarantee transfers the applicant’s creditworthiness to the bank. ALSO READ Why do companies need to manage their guarantees? Companies that engage in substantial contractual agreements that can impact financial risk need to manage all the related guarantees, provided that a guarantee is issued. As a result, finance and treasury teams typically practice some form of guarantee management, for example, by keeping track of guarantees and status in spreadsheets to gain better control. It’s important to keep track of guarantees in order to move forward with agreements in a timely fashion and to control the costs and risks of agreements. Another important aspect of trade finance is risk mitigation and settling any conflicts between trading partners. For example, the buyer usually wants to mitigate the payment risk and ensure security if, for some reason, the seller does not provide the agreed-upon goods or services. In contrast, the seller wants to mitigate supply chain risk. By using guarantees, companies minimize the risk in such situations and can move forward with agreements in a more secure manner. Challenges in traditional guarantee management processes Guarantee management traditionally implies a good amount of paperwork and manual spreadsheets where information about each guarantee is recorded and updated. The management is, in most cases, also decentralized, where every entity or subsidiary has its own ways of dealing with guarantees. As a result, there is much scattered data in various places, and processing guarantees become slow due to inefficiency and lots of required communication. Especially since several stakeholders are involved throughout a guarantee’s lifecycle, both internally and externally. In practice, that implies that many emails need to be sent back and forth between people, and if various entities need to align on guarantees or a corporation decides to issue guarantees for its subsidiaries, there is no standardized process in place that streamlines the communication, guarantee status, or tasks for all stakeholders. Traditional setups are a nightmare for companies that process tens, hundreds, or thousands of guarantees. Common goals in guarantee management Most companies that are looking to improve their guarantee management processes share the following common goals: Desired guarantee management setups The aforementioned goals are paired with a desired state of guarantee management that is centralized in a digitalized environment. All employees responsible for guarantee management or those with a role in the guarantee lifecycle should be able to log on to that same system, regardless of whether they work for a corporate or a subsidiary. It’s just a matter of user management and ensuring that users have adequate permissions to view and edit the guarantees relevant to their jobs. Communication between colleagues and adjustments to guarantees should only be done in the same system. It should also be able to provide overviews of all guarantees and their statuses, as well as which guarantees require action to move them forward in the process. On top of that, a guarantee management setup should be designed to be standardized for every bank. Typically, banks issue their own guarantee forms that all require information to be filled out slightly differently depending on which bank you are dealing with. This adds another layer of complexity and additional work to the process. Instead, digitalized tools can be used for creating standardized guarantee forms that can be sent to any bank, regardless of their requirements. By doing so, treasurers can save significant time because all guarantee applications follow the same standard digital format. A modern, digital guarantee management process An example…

Treasury Mastermind Feature: Contact a Member

At Treasury Mastermind, we’re dedicated to continually improving the user experience and strengthening the bonds within our community. That’s why we’re thrilled to announce the rollout of an exciting new feature: private messaging. As we embark on this journey to enhance community engagement, it’s essential to understand the significance of facilitating private communication among our members. Beyond the realm of public discourse, private messaging opens up a world of possibilities for deeper collaboration, knowledge sharing, and relationship building. One of the most significant advantages of private messaging is the ability for members to engage in candid conversations without the constraints of public scrutiny. Whether it’s discussing sensitive topics, seeking advice on personal matters, or sharing ideas in a more intimate setting, private messaging empowers our community members to connect on a deeper level. Moreover, private messaging fosters a sense of belonging and camaraderie within our community. By providing a platform for members to communicate directly with one another, we’re creating a space where individuals can forge genuine connections, offer support, and build lasting relationships based on mutual interests and shared goals. So, we are inviting everyone to make us aware of this future. ALSO READ: Introducing Article Sharing on Treasury Mastermind How to get started Follow these steps to contact a member on the forum: Step 1: First, ensure you are a registered member and logged in, then click on the “Treasury forum” menu at the top right and a drop-down menu will appear. Step 2: When the drop-down menu comes up, click on “registered members” to access any member on the forum. Step 3: On the “registered members” page, scroll to find a member or you can use the search bar to search for a specific member you want to chat with. Step 4: When you have identified a member you want to contact, click on their profile and you will be directed to their profile section. Step 5: On the profile section, scroll down, and at the bottom right, click on “send message” and you will be directed to the chat section, where you can send a member a private message. Step 6: In the chat section, you can type your message and then hit send when you are done. Please Note: You can click on a member’s profile anywhere on the forum to also view their profile and send a message to them privately. So, whether you’re a seasoned veteran or a newcomer to our forum, we invite you to take advantage of this exciting new feature and start exploring the possibilities of private messaging. Together, let’s continue to build a vibrant and supportive community where ideas flourish, relationships flourish, and everyone has a voice.

Security in Finance for 2024 in a Transformed Banking Landscape

This article is written by Cobase As the corporate finance landscape undergoes rapid transformation in 2024, businesses find themselves at the intersection of innovation and vulnerability. The dispersed banking model, characterized by digital transactions and decentralized operations, poses unique security challenges that necessitate a forward-thinking approach. This shift, while primarily driven by digitalization, also sees Payment Service Providers (PSPs) playing an increasingly supportive role in facilitating seamless financial operations. This blog post delves into the critical security considerations for corporates in this new era, offering insights into maintaining robust security postures amidst evolving risks. The Evolution into 2024: A Dispersed Banking Landscape The transition towards digital banking was significantly accelerated by the global events of 2020-2023, leading to a dispersed banking model characterized by remote operations, digital transactions, and the integration of fintech solutions. A report by the Federal Reserve highlighted a 200% increase in mobile banking traffic and a 150% surge in online account registrations during the initial phase of the pandemic, setting a precedent for the future of banking. The Security Imperatives in 2024 With this digital transformation, the security risks for corporates have evolved, necessitating a reevaluation of traditional security frameworks. Phishing attacks, ransomware, and data breaches are on the rise, with IBM’s Cost of a Data Breach Report 2023 indicating the average cost of a data breach reaching $4.35 million, a stark reminder of the financial and reputational stakes involved. Key Security Considerations for Corporates The Role of Regulatory Bodies and Standards As corporates adapt to the dispersed banking model of 2024, the emphasis on security must be integral to their operational strategy. This involves not just adopting advanced technological solutions but also fostering a holistic approach to security that encompasses regulatory compliance, employee education, and strategic partnerships. Conclusion The journey through 2024 and beyond will be characterized by a delicate balance between embracing the efficiencies of the digital banking landscape and mitigating the inherent security risks. For corporates, the path forward involves a comprehensive security strategy that integrates technological, regulatory, and human elements. By doing so, they can navigate the complexities of this new era with confidence, ensuring the security and integrity of their financial operations in the face of evolving threats. Corporates must take a proactive stance in enhancing their security measures, staying abreast of regulatory changes, and fostering a culture of continuous improvement and vigilance in cybersecurity practices. By doing so, they can protect their assets, maintain customer trust, and thrive in the dynamic world of finance in 2024 and beyond. Also Read Join our Treasury Community Treasury Masterminds is a community of professionals working in treasury management or those interested in learning more about various topics related to treasury management, including cash management, foreign exchange management, and payments. To register and connect with Treasury professionals, click [HERE] or fill out the form below to get more information. Notice: JavaScript is required for this content.

The Risks of Not Adopting a Treasury Management System

This article is written by Kyriba When evaluating the implementation of a treasury management system (TMS), there will always be the inevitable question of why? Each company has processes in place that have worked up until now, so why should we fix what isn’t broken today? Although current processes have worked in the past, there are many risks associated with maintaining manual and disparate treasury practices that can impact the company’s reputation and bottom line. In this blog, which is part of our Value Engineering series, we explore some of the top risks that are often overlooked when evaluating the status quo versus the future state of a TMS. Lack of Insights into Global Liquidity CFOs face daily decisions that can impact the financial stability and longevity of their organization. They require access to timely and reliable insights into the company’s global liquidity position to ensure effectiveness and alignment with strategic objectives. Ever-changing economic, political, and social factors create volatile conditions, often resulting in small windows for decision-making. The treasurer must be able to provide updated insights at a moment’s notice and have confidence that the information is complete and accurate. Without a TMS in place, data is often stale, or market conditions may have changed by the time it reaches the CFO. This can result in a strategic business opportunity no longer being available. In addition to the risk of delayed insights, there is also a heightened risk of human error. Keying mistakes, formula errors, and file corruptions are all risks that could halt a treasurer’s ability to operate efficiently without impacting an organization’s bottom line or its reputation. As a former practitioner, I worked at an organization that closely monitored the release of payments to ensure compliance with quarterly debt covenants. Before the adoption of a TMS, this required labor-intensive and manual review, selection, and release of payments each month, end, or quarter. Although policies and procedures were in place to ensure that only approved payments were processed, it came down to the wire with emails requesting the urgent holding or release of payments. In one instance, this practice resulted in a $2.5 million payment being sent without a division CFO’s approval. A TMS with systematic analysis of available liquidity and payment controls would have prevented the release of this payment, saving the company and the treasurer’s career. Business Continuity Businesses with an antiquated treasury process are unable to optimize human capital, often resulting in reduced employee satisfaction, elevated turnover, and an inability to develop and grow talent. The cost associated with ongoing staff training, as well as reduced operational efficiency due to turnover, needs to be evaluated. Additionally, the potential for increased overhead must also be assessed when analyzing how the current structure would be able to support continued growth and expansion. How will the organization manage operations with a 10%, 20% or 30% growth trajectory with the current team structure? Automating processes through treasury software enables a strategic competitive advantage with talent retention and development, reducing the risk of employee turnover, as well as the organizational risk associated with overreliance on subject matter experts. Heavy Reliance on IT for Maintenance & Support IT departments may be stretched thin and often struggle to provide adequate and timely support across the organization for various projects and executive-level initiatives. In addition, the constant threat of the newest cyberattacks means that IT must constantly ensure that its policies, procedures, and safeguards are up-to-date. Unfortunately, competing demands can mean delays in Treasury maintenance to make sure that all bank-to-ERP connections are encrypted, maintained, and supported for change management. Bank connectivity is one of the most complicated and time-consuming demands a Treasury department can ask of IT. When a new relationship or account is formed and an ERP connection needs to be established, internal IT departments can spend up to 1,500 hours developing, testing, and then deploying bank files in coordination with the bank’s implementation teams for just one format. During this transitionary period, Treasury departments are forced to create workarounds, struggling to do so without operational disruptions. Business operation disruptions have a reputational impact on the organization. During my time as a Treasury Manager, our bank-to-ERP connection failed and suddenly, payment files were not being processed. Payment timing was essential to keeping the just-in-time manufacturing lines of our customers going. This file failure put one of our customers at risk of shutting down production due to a lack of payment, which would have caused us to lose preferred supplier status and could have destroyed our reputation in the industry. A TMS with a global support staff that constantly monitors and maintains connections and proactively alerts organizations if there are any issues would have solved these problems. Compliance & Controls Regulatory and compliance requirements continue to evolve, putting considerable pressure on the treasurer to verify that their treasury processes and procedures are up-to-date. Ensuring that all reporting obligations (OFAC, J-SOX, FBAR, KYC, internal/external audit, etc.) are met is a laborious task. If not constantly monitored and maintained, it can have detrimental financial and reputational impacts on the organization. With a TMS in place, all reporting and systematic audit trails are in a centralized location. Payment validation through a TMS ensures that all payments are legitimate and meet the most recent regulatory requirements. This protects the company from the release of any transaction that does not meet policy or regulatory guidelines. Standardizing controls and supporting compliance reporting enable treasurers and CFOs to focus their energy on more strategic concerns. Next Steps Evaluating the risk associated with the status quo can be a painful process. Change is scary and no one wants to acknowledge pitfalls in their current processes. Although certain situations or consequences may not have occurred, with manual and disparate practices, it is a matter of when something will break and how the company can protect itself and recover when it does. Since we are often blinded to the possibility of the potential impact of our current treasury processes, many organizations choose to seek external help in assessing the risks associated with their status…