Tax considerations in light of Transfer Pricing when setting up Zero-Balance Cash Pool arrangements

International companies are taking advantage of group synergy by entering into cash pool arrangements to support a group strategy. This strategy usually includes improved cash management and interest yields on cash. Cash pool arrangements are rarely (or not at all) found between independent parties. Such arrangements may attract the attention of local tax authorities. This will…

Guidelines for Transfer Pricing related interests & spreads applied in Zero Balancing Cash Pools – Part 2

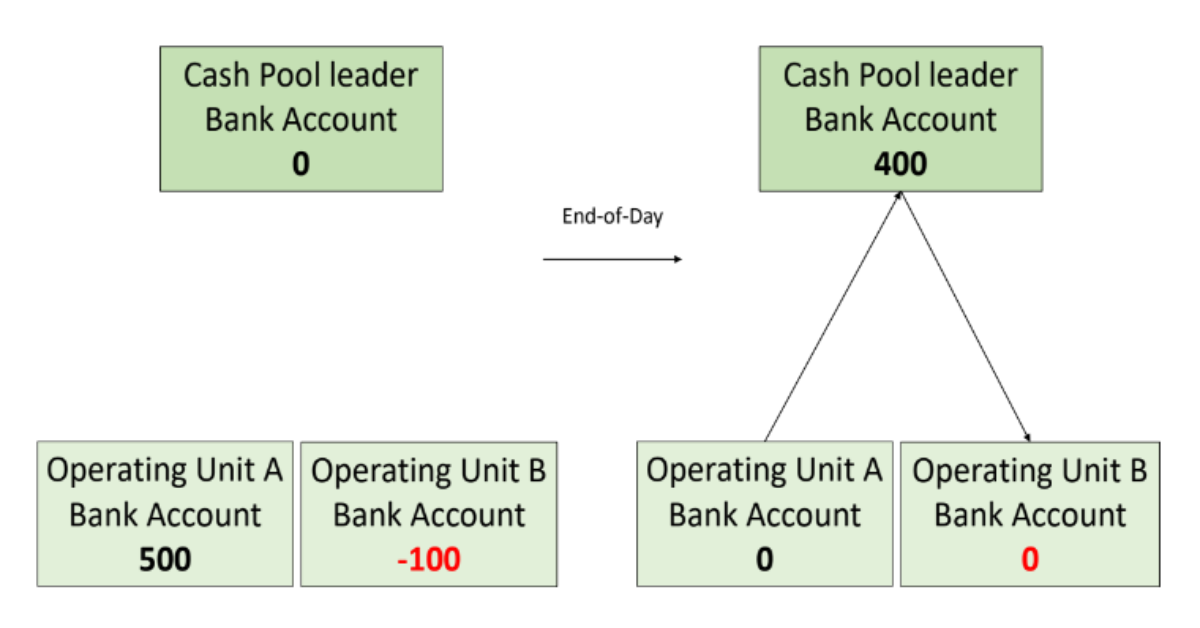

Executive summary A Zero Balancing structure mirrors the core activity of a bank. Therefore, managing a Zero Balance Account (ZBA) structure requires a corporate treasury to operate an In-House Bank. This In-House Bank must apply Arms-Length interest to balances in its In-House Bank accounts as well as to InterCompany Lending and Depositing/Investing, both debit and…

Guidelines for Transfer Pricing related interests & spreads applied in Zero Balancing Cash Pools – Part 1

Executive summary A Zero Balancing structure mirrors the core activity of a bank. Therefore, managing a Zero Balance Account (ZBA) structure requires a corporate treasury to operate an In-House Bank. This In-House Bank must apply Arms-Length interest to balances in its In-House Bank accounts as well as to InterCompany Lending and Depositing/Investing, both debit and…

OECD BEPS and Transfer Pricing: Differentiating In-House Bank Interest Depending on Balance Sheet

When companies set up a Zero Balancing Cash Pools structures, tax authorities scrutinize in-house bank solutions and apply interest spreads. To support this, a number of countries are working together through the OECD organization. They aim to streamline economic market forces and have defined guidelines accordingly. This measure aims to prevent tax base erosion and…