This article is written by Nomentia

Treasurers have a love-hate relationship with guarantees. While they are usually not a big concern as long as there are few, managing hundreds or even thousands of various types of guarantees across different entities, guarantors, beneficiaries, countries, and therefore languages and jurisdictions can be a nightmare, especially without the right tools. Below, we provide insights into what managing guarantees actually means, what the challenges are when doing so and why doing it right equals less time spent and money saved. In the second part of this post, we provide an overview of the capabilities that modern, digital guarantee management solutions offer and their benefits.

JOIN OUR FORUM TODATY!

Are you an experienced treasurer or someone looking to enhance their knowledge of financial management? We extend a warm welcome to Treasurymastermind.com

Join our vibrant community and become a valued member of a network that prioritizes collaboration, expertise, and the pursuit of excellence in corporate treasury.

Let’s initiate discussions and together elevate the art and science of treasury management!

Why guarantees matter

Guarantees facilitate trade by assuring the buyers/project owners (“beneficiaries”) that the guarantor, usually a bank or (credit) insurance company – will uphold a contract in case the seller/contractor (“the applicant” to the guarantee) is unable to do so. They are therefore a vital tool heavily used across sectors as varied as construction, facility management, manufacturing, and retail and across the different stages of a business transaction, from bidding for a project, the delivery of the goods or performance of the services to ensuring pre-agreed services during the warranty period. By committing to paying the agreed amount upon first demand by the buyer, the guarantor (usually a bank or credit insurer) assumes risk. Compensation for this risk is in the form of various guarantee-related fees. Also, guarantors usually only agree to assume a pre-defined amount of risk for any given company in the form of a pre-agreed guarantee facility. Against this background, it is obvious that managing large portfolios can be a challenge. Not only is the timely processing of guarantees from various facilities agreed upon with various banks, but sometimes hundreds, if not thousands, of different types of guarantees can be challenging.

What is guarantee management?

Guarantee management means the management of all guarantees for a company. A guarantee itself is a way of showing a counterparty that you are a secure contracting party. The guarantee is set up with a third party, most often a bank. The bank acts as a mediator and becomes the guarantor as the guarantee transfers the applicant’s creditworthiness to the bank.

ALSO READ

Why do companies need to manage their guarantees?

Companies that engage in substantial contractual agreements that can impact financial risk need to manage all the related guarantees, provided that a guarantee is issued. As a result, finance and treasury teams typically practice some form of guarantee management, for example, by keeping track of guarantees and status in spreadsheets to gain better control. It’s important to keep track of guarantees in order to move forward with agreements in a timely fashion and to control the costs and risks of agreements.

Another important aspect of trade finance is risk mitigation and settling any conflicts between trading partners. For example, the buyer usually wants to mitigate the payment risk and ensure security if, for some reason, the seller does not provide the agreed-upon goods or services. In contrast, the seller wants to mitigate supply chain risk. By using guarantees, companies minimize the risk in such situations and can move forward with agreements in a more secure manner.

Challenges in traditional guarantee management processes

Guarantee management traditionally implies a good amount of paperwork and manual spreadsheets where information about each guarantee is recorded and updated. The management is, in most cases, also decentralized, where every entity or subsidiary has its own ways of dealing with guarantees. As a result, there is much scattered data in various places, and processing guarantees become slow due to inefficiency and lots of required communication. Especially since several stakeholders are involved throughout a guarantee’s lifecycle, both internally and externally.

In practice, that implies that many emails need to be sent back and forth between people, and if various entities need to align on guarantees or a corporation decides to issue guarantees for its subsidiaries, there is no standardized process in place that streamlines the communication, guarantee status, or tasks for all stakeholders. Traditional setups are a nightmare for companies that process tens, hundreds, or thousands of guarantees.

Common goals in guarantee management

Most companies that are looking to improve their guarantee management processes share the following common goals:

- Transparency at the corporate level: group-wide overviews that allow you to quickly see the bigger picture of all existing guarantees at any time.

- Transparency for subsidiaries: allowing subsidiaries to keep track of and view all, guarantees that were issued on their behalf.

- Control of guarantee exposure: the utilization of current facilities is clearly presented, allowing quick calculations and clarification on the available resources for planned guarantee requirements.

- Invoicing of internal guarantee charges: invoicing functionalities for dealing with fees and commissions related to guarantees.

- Time-savings: automating and digitalizing the end-to-end guarantee process from application to bank approval to storing all guarantee-related records in a single platform with the help of customizable workflows. All in all, improving efficiency over the course of the entire guarantee lifecycle.

Desired guarantee management setups

The aforementioned goals are paired with a desired state of guarantee management that is centralized in a digitalized environment. All employees responsible for guarantee management or those with a role in the guarantee lifecycle should be able to log on to that same system, regardless of whether they work for a corporate or a subsidiary. It’s just a matter of user management and ensuring that users have adequate permissions to view and edit the guarantees relevant to their jobs. Communication between colleagues and adjustments to guarantees should only be done in the same system. It should also be able to provide overviews of all guarantees and their statuses, as well as which guarantees require action to move them forward in the process.

On top of that, a guarantee management setup should be designed to be standardized for every bank. Typically, banks issue their own guarantee forms that all require information to be filled out slightly differently depending on which bank you are dealing with. This adds another layer of complexity and additional work to the process. Instead, digitalized tools can be used for creating standardized guarantee forms that can be sent to any bank, regardless of their requirements. By doing so, treasurers can save significant time because all guarantee applications follow the same standard digital format.

A modern, digital guarantee management process

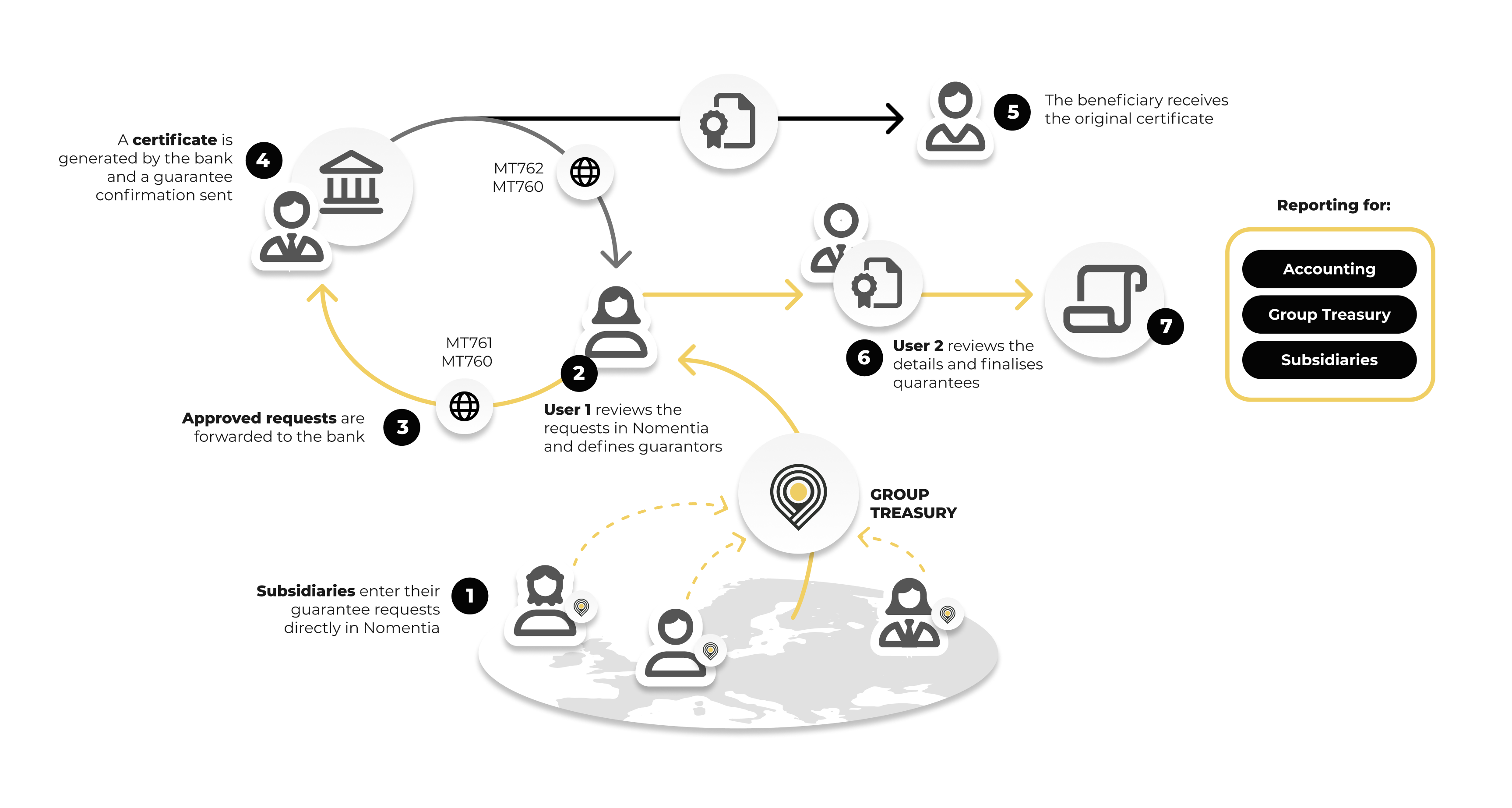

An example of the desired state of the guarantee management process looks similar to the illustration below. In brief:

- Someone in the subsidiary enters a request for a guarantee in the centralized system.

- Another user (often in group treasury) receives a notification, reviews the guarantee, and defines the guarantors.

- Requests can be approved, rejected, modified, or sent back to add more context.

- If the request is approved, it will be forwarded to the bank in MT798, MT761, or MT760 format or via SWIFT FileAct.

- The bank generates a certificate, and a guarantee confirmation is sent, or more information is requested.

- The electronic bank confirmations are subsequently imported into the system and compared with the guarantee request for security purposes. If everything is correct, the process is soon ready to be closed.

- The beneficiary receives the original certificate.

- Another user internally receives a notification and still reviews and finalizes the guarantee. Then it is automatically added to reporting for accounting, group treasury, and its subsidiaries.

Once a guarantee was issued, you need to deal with the associated fees. This involves breaking guarantee-related charges down into different classes for them to be calculated and allocated accordingly. The easier part is differentiating between issuing and amendment charges and minimum commissions. External charge classes can be used to check that the charges billed by banks and credit insurers are correct. With the help of internal charge classes, group treasury can identify the amounts that need to be forwarded to the relevant subsidiaries. Once automated, this will save the accounts department a considerable amount of work related to booking guarantees and setting up accruals, and it will allow the treasury department to analyze the utilization of guarantee lines directly in the system.

Keep in mind that the desired state works so that all guarantees in different lifecycle stages can be tracked so that you have a complete overview of which guarantees are in what stages. Another important factor in efficiency is streamlining communication processes. Ideally, all communication is done through the same platform. For example, you should be able to comment on specific guarantees, and the relevant users should receive notifications when action is required from them, or when messages concern them.

Add-on: guarantee fee management and invoicing

Some systems, like Nomentia’s, also offer extensive add-ons that tackle guaranteed invoicing. Some of the following invoicing features can help improve the process:

- Flexible and modifiable pricing schedule with differentiation by external, internal, flat, and time-dependent fees and commissions.

- Automated generation of related reports without manual inputs.

- Generation of ready-to-go invoices.

Benefits of a guarantee management software

All the steps mentioned above in a desired guarantee management setup can be realized with software. Software also offers many other benefits. These are some of the critical benefits that a solution like Nomentia Trade Finance provides:

- Complete centralization of guarantee management

- Automation of the guarantee process with the help of customizable workflows

- Optimal user management and task notifications for when certain users require actions

- Complete presentation of all guarantee types and transactions involving sureties

- Comprehensive analysis; numerous reports for quick analysis of guarantee types and the corresponding facilities

- Intuitive user interfaces that are customizable and allow you to capture data easily

- Ability to attach relevant documents to the corresponding guarantee to keep track of all relevant information

- Subsidiaries can readily access, view, and update guarantees that were issued on their behalf

- Flat and maturity-dependent fees can be calculated and invoiced

- All workflows are monitored with an end-to-end audit trail for security and compliance reasons

- Supports compliance principles of security, dual control, and continuity

- Usage of automatic internal billing for automation of internal guarantees

Examples of company transformations

To illustrate how optimal processes can benefit companies, here are a few examples of the customers that we have helped with trade finance and guarantee management:

Bertelsmann SE & Co.KGaA, the largest media group in Europe, uses Nomentia Trade Finance to automate issuing invoices for guarantee-related charges and commissions. They also decreased the treasury workload due to the centralized management of data by subsidiaries and automated processes related to data-input reminders. Now, Bertelsmann’s treasury team can also run extensive analyses based on group-wide guarantees.

DNV GL, a provider of technical assurance, advisory, and software in maritime, oil & gas, and other industries, uses Nomentia Trade Finance to centrally track guarantees and manage the end-to-end lifecycle from request to derecognition and everything in between, including associated reporting on the guarantee portfolio and related fees. As part of a project that was started in 2022/2023, DNV is extending the solution to also cover the guarantee-related communication flow with banks using SWIFT MT-messages.

To conclude

To summarize, companies managing a large portfolio of guarantees that are still relying on legacy processes based on reams of paper and large Excel sheets have a lot to gain from transitioning to a digitalized process. By centrally tracking and managing group-wide guarantees digitally, leveraging smart workflows involving all relevant stakeholders based on optimal processes and stakeholder management, Treasury and finance professionals should look into how they can. Most companies resort to guarantee management software to maximize control and efficiency. In the end, we recommend talking to other companies or one of our guarantee management experts, they can advise you on how to improve your current setup.

Third-party risks are inherent of a company’s risk portfolio. On one side, customers’ are worried that their suppliers will fail to fullfill their obligations and/or repay the advance payment made to them, and on the other side suppliers are worried that their customers will fail to pay them on time (or not at all).

The recent financial, health and debt crisis, together with political instability and difficult economic situations in numerous countries have increased this sentiment of constant credit and commercial risks, which as a consequence have altered commercial relationships.

This is the essence of why bank guarantees exist.

But…Bank guarantee = blank cheque!

It is key to reiterate the independence aspect: the obligations arising out of the bank guarantee are solely those of the bank guarantee document itself, and has no link whatsoever with another document, such as a contract. It has therefore no other underlying obligations than those specifically mentioned on the bank guarantee. This creates a lot of risk for companies and tedious to control and get visibility on.

I cannot agree more that trade finance often means manual intensive activities, highly reliant on humans performing tedious task in a complex environment, with changing regulation, practices, relationships, …

Just like for accounting, shipping, treasury… more and more software are available on the market to help facilitate those transactions as much as possible.

It is a huge market for providers of such technology, as currently very fragmented and demand is increasing due to the increase in volumes and complexities (and pressure on cost…)

I’ve experienced and implemented it myself, combined with PowerApps to facilitate the instruction workflow, better visibility for the whole group on status of guarantees, avoiding a lot of back and forth and better manage workload, on top of creating powerful KPIs.

On top of it, the use of RPA is really interesting as it automated the inputs into the system(s). Now if you can implement only one system to manage all bank guarantees (and even letters of credit, corporate guarantees, surety bonds…) even better, as these software offer:

– Track and trace solutions

– Connectivity with all financial intermediaries, offering visibility over all trade finance activities portfolio into one location

– More efficient workflow (from submission to cancellation, going through issuance, amendments, extend or pay,… with communication mainly by Swift and less reliant on Emails and paper-based solutions

Better reporting (homogenous format and automated) which translates in time saving for your staff and real-time visibility over credit facilities

– Automated filling of documents being presented under letters of credit, allowing a drastic reduction in discrepancies and time spent in filling in documents

– Connectivity with Treasury Management Systems (TMS), enabling cash forecasting capabilities and risk management

–> Some of these technologies can even help issue surety bonds, corporate guarantees, etc.

–> Robotics solutions also help automate low added value tasks such as filling in application on bank’s portals…