What are Multi-Bank Platforms

This article is a contribution from our content partner, Just Introduction to Multi-Bank Platforms Multi-Dealer platforms are a great example of how technology continues to improve markets. These electronic platforms are non-exchange financial trading venues which enable trade matching between counterparties, offering pricing from a selection of investment banks. After the introduction of electronic broking…

The Modern Treasurer: A Strategically Skilled Financial Leader

Treasury professionals must possess a diverse set of competencies. Treasury Masterminds recently conducted a poll among nearly 100 treasury professionals, exploring the question: “What do you think is the most important skill for a treasurer to have?” The findings offer valuable insights into the treasury function’s evolving demands and highlight the multifaceted nature of the…

The Three Lines of Defense: Simple in Theory, Tougher in Practice

This article is a contribution from one of our content partners, Avollone What’s the deal with the 3 lines of defense? When speaking to funds and other regulated companies, I almost always discuss the Three-Line Defense (LoD) model. The idea of the lines of defense was first formulated in 2011 by the Basel Committee in their report “Principles…

FX Hedging Is a Journey with a Destination

This article is written by HedgeFlows Navigating the complexities of foreign exchange (FX) markets and currency risks can feel daunting, especially for growing and mid-market businesses that trade internationally. Uncertainties in global markets can significantly impact financial stability, profit margins, and cash flows if left unaddressed. However, this uncertainty does not need to dictate your…

The U.S. Finally Catches Up to the Rest of the World on Payments

In a move that’s been a long time coming, the United States Treasury is finally getting rid of paper checks. On March 25, 2025, President Trump signed an executive order mandating that all federal payments and collections go digital by the end of September. While the rest of the world has been making payments electronically…

Cash Flow Hedging in Eruptive Currency Markets

This article is written by GPS Capital Markets This summer my family visited Yellowstone National Park. At Mammoth Hot Springs Historic District, near the north entrance of Yellowstone, I learned about the park’s history. This was the first national park ever established, with a vast coverage area (3,472 square miles or 8,992 kilometers), limited financial…

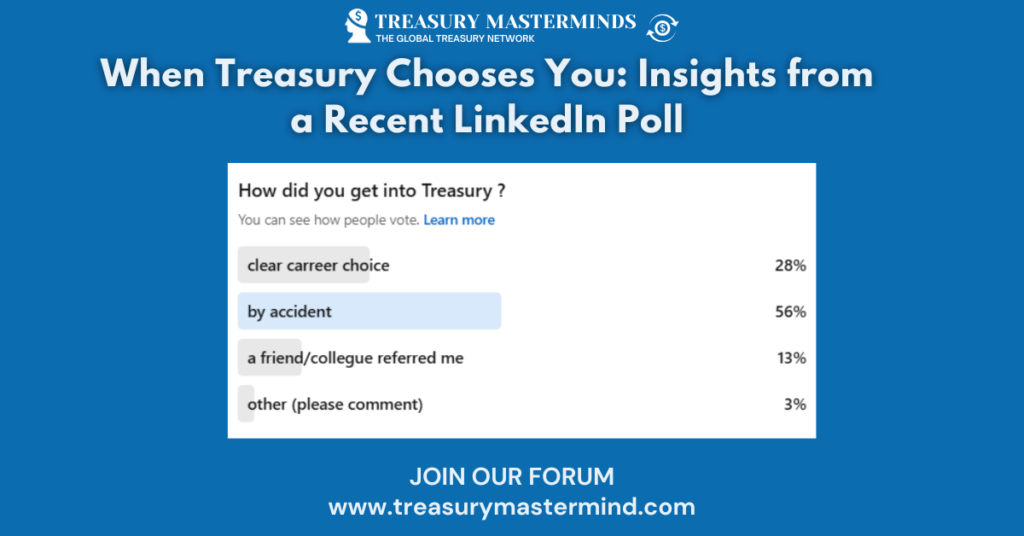

When Treasury Chooses You: Insights from a Recent LinkedIn Poll

Careers can take unexpected turns, and for many Treasury professionals, the path into their field seems to have been anything but straightforward. A recent LinkedIn poll posed the question, “How did you get into Treasury?” and the results offer a glimpse into the varied ways professionals land in this critical area of corporate finance. Here’s…

Top features to look for in in-house bank software

This article is written by Nomentia Executive summary: For global businesses looking to harmonize their cash management and gain control and visibility over their payment operations, an in-house bank is an obvious choice. In this article, we answer the following questions: What are the core functionalities of in-house bank software, and how does in-house bank…

How to Tackle Troublesome Tariffs with 5 Savvy Working Capital Solutions

This article is a contribution from our content partner, Kyriba Widespread uncertainties surround the economic impacts of the second Trump administration, especially in regards to the potential for significant tariffs on the U.S.’s top three trading partners–Mexico, Canada, and China–as well as Europe. In response to Trump’s threat of 25% tariffs on goods, both Canada and Mexico have suggested imposing retaliatory tariffs on…