This article is written by TIS Payments in 2023

At-a-Glance: So far in 2023, there have already been several high-profile institutional banking failures including Silicon Valley Bank (SVB) and Signature Bank, as well as the sudden acquisition of Credit Suisse by UBS. Uncertainty regarding First Republic Bank and other various regional banks has also persisted as a sustained liquidity crunch threatens their daily operations. These unexpected incidents have underscored the need for treasury and finance teams to develop and maintain a bank connectivity structure that supports their need for simplicity, automation, and control without creating an overreliance on any single partner or relationship.

In the modern technology era, a popular strategy for accomplishing this is by deploying a multi-bank connectivity solution that is not tied to any specific bank and that can synchronize workflows across a company’s global banking partners by integrating them all through a unified platform. This approach enables treasury and finance practitioners to easily maintain global visibility and control across their full spread of bank connections and accounts, and it enhances their ability to quickly react and pivot to a shifting financial landscape as various bank relationships, regulations, integration methods, financial messaging standards, and other components evolve.

Uncertainty in the Banking Environment is a Huge Deal for Treasury & Finance Teams

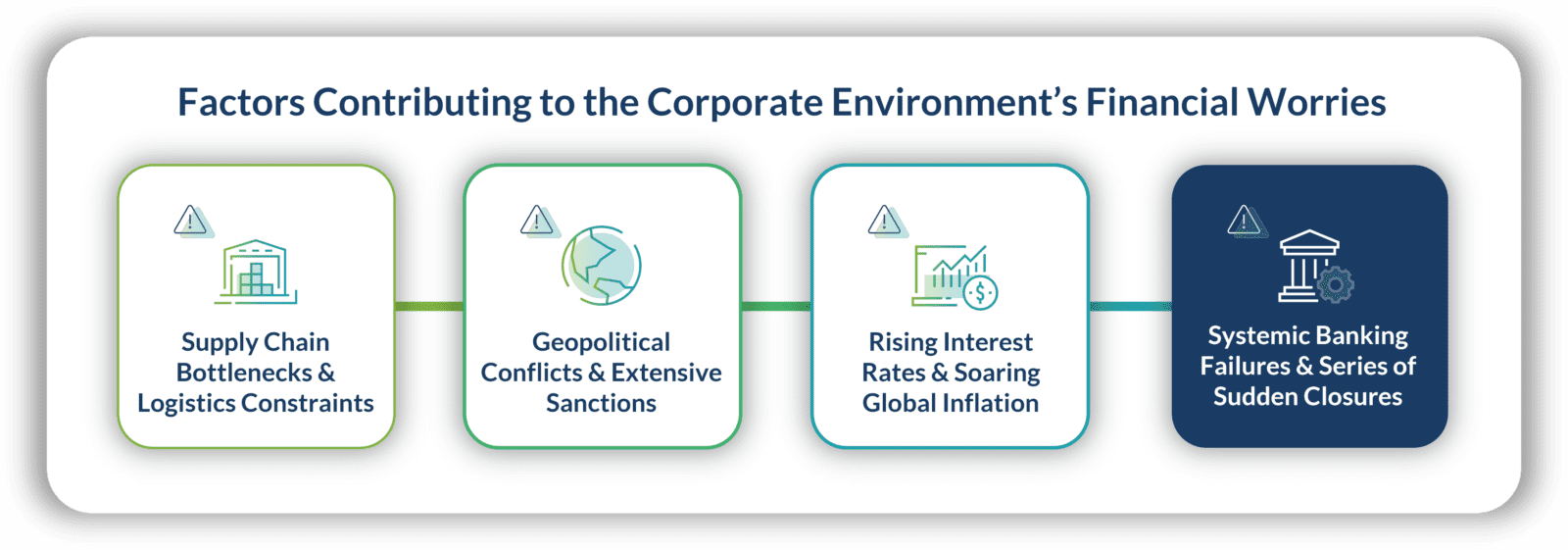

During Q1 of 2023, tepid performance across the financial markets has done little to dispel widespread feelings of uncertainty about the state of the global economy. With the aftermath of the Covid pandemic still fresh in everyone’s mind and many companies now facing subsequent supply chain bottlenecks, heightened geopolitical turmoil, and rising interest rates coupled with soaring inflation, it’s easy to see why risk management has remained top-of-mind for many industry professionals.

But recently, the added uncertainty and turmoil caused by a series of high-profile banking failures including Silicon Valley Bank (SVB) and Signature Bank, as well as the sudden acquisition of Credit Suisse by UBS, have sparked even greater worry over whether the global economy can handle further financial duress.

Today, these concerns are weighing particularly heavily on those operating within the corporate treasury and finance arenas.

Why is this?

From an operational perspective, treasury is typically responsible for monitoring and controlling their organization’s banking workflows, account balances, payments activity, and underlying cash flows. Practitioners usually approach these responsibilities by attempting to automate and optimize as much of their processes as possible to drive efficiency and simplicity, but there is often a risk management element associated with the function as well. That is, addressing the risk that any of the company’s banking partners, account balances, or associated cash flows could be impacted by an adverse event or unanticipated scenario that suddenly drains liquidity or renders some or all of it inaccessible (i.e. due to a fraud attack, natural disaster, geopolitical conflict, economic catastrophe, etc.)

In many cases, the bank relationships that treasury oversees are spread across numerous countries, currencies, institutions, and accounts. But, there are usually a few core banking partners that help companies manage the bulk of their liquidity and payments activity. Often, having these core partners is helpful because treasury can rely on them to sustain daily operations without overcomplicating their business landscape or having to deal with dozens of separate providers and connections. However, if one of these core banking partners were to unexpectedly fail, how would that impact the organization’s payments and cash flows? Would it be easy to redirect these processes through a new bank, recover the liquidity held in the collapsed bank, and develop a new workflow to transact with vendors, customers, and partners in an efficient manner?

Given the critical nature of payments and cashflow activities for supporting day-to-day business operations, treasury could end up dangerously short on options if a bank closure prevented them or their AP and HR colleagues from paying supplier invoices, debt settlements, or employee salaries. If millions of dollars in cash or more is suddenly unavailable and payments are not being executed, companies without the proper bank contingency plan will face significant challenges trying to source alternative liquidity and route it through new networks or channels.

Treasury Must Balance Their Need for Banking Automation & Simplicity with Risk Management Best Practices Via Ample Diversification & Integration

For many organizations, addressing the above risks is not easy — especially not for treasury groups that have become overly reliant on a single banking partner or a select few institutions to manage cash and payments. And for companies still using individual bank portals to manage the bulk of their payments activity with their partners, then a bank closure impacting one of these key institutions is even harder to overcome.

Of course, the “surface-level” response to this challenge is to simply suggest that treasury should diversify their assets across a greater number of banks and accounts. But the answer is not that simple.

Over time, each new bank and set of accounts added by a company will result in greater complexity across the back-office as additional connections, data, information, and relationships must be managed. In the long run, a company that overdiversifies their relationships across too many banks and accounts will ultimately suffer from a garbled mess of bank portals, payment workflows, and reporting gaps that negate any benefit derived through the reduction in risk. In fact, they may even create added risk due to an increased threat of fraud and compliance gaps as cash and payment activity is spread across more points of exposure.

But given the extent that modern treasury teams must rely on their banking partners to ensure cash flows and payments are properly transmitted and orchestrated on a global scale, how are practitioners supposed to adequately protect against the potential fallout of a banking failure without growing overdiversified, siloed, or inefficient in the process?

For a growing number of companies, the answer lies in multi-bank connectivity solutions.

Using a Multi-Bank Connectivity Solution Enhances Treasury’s Ability to Orchestrate Global Cash Flow, Payments, and Liquidity During Times of Crisis

In today’s digital and fast-paced financial environment, an increasingly common practice amongst treasury teams is to adopt software that can support the full spectrum of their bank connectivity options as part of a single, unified platform. These multi-bank connectivity hubs are often provided by Fintechs as part of a cloud-based service, and most of them can handle the full scope of banking channels and connectivity requirements in use by organizations, regardless of whether it’s through SWIFT, APIs, SFTP, or otherwise.

This streamlined configurability enables companies to more easily maintain visibility and control across all their bank relationships without having to maintain individual portals or systems, and it also helps companies respond to unexpected banking scenarios by having real-time, centralized insight to their global liquidity, cashflow, and payments activity. Leveraging a platform that aggregates and classifies all of treasury’s bank connections and account information also makes it much easier to reroute payments activity and direct liquidity through alternative channels in the event of a specific outage or series of outages.

As a result of the capabilities afforded through today’s leading multi-banking solutions, a huge portion of treasury and finance’s functions surrounding payments, cashflow, financial messaging, account management, and reporting become monumentally easier. At the same time, fraud and compliance exposures can be more effectively eliminated through the standardization of protocols and enforcement of clear policies for managing signatures, approvals, documentation, and user privileges.

Over the past decade, cloud-based connectivity solutions have seen a rapid rise in popularity and adoption amongst corporate treasury and finance teams, particularly those operating at larger multinational organizations. In 2023, one of the leading providers of this type of technology is the company I co-founded in 2010, Treasury Intelligence Solutions (TIS).

Also Read

- Biopharmaceutical Giant Breaks out of the Cash Forecasting Mold

- Reviewing Best Practices for Treasury’s Cash Flow Forecasts

- Intercompany Transactions Guide: Meaning, Management & Strategies

- Keys to Achieving Financial Data Integration & Process Automation in Treasury Technology

- Identifying the ROI in a Treasury Transformation Project

- Reviewing Treasury Best Practices for Bank Account Management in 2023-2024

Join our Treasury Community

Treasury Masterminds is a community of professionals working in treasury management or those interested in learning more about various topics related to treasury management, including cash management, foreign exchange management, and payments. To register and connect with Treasury professionals, click [HERE] or fill out the form below to get more information.