What is the role of a corporate treasurer?

A corporate treasurer is responsible for the safekeeping and strategic management of your company’s money. They’re the financial wizards behind the scenes, juggling cash flow, mitigating risks, and maximizing returns on your investments.

Imagine your business as a giant ship sailing across the vast ocean of commerce. The captain steers the course, but who manages the fuel, repairs the sails, and ensures smooth passage through financial storms? That’s the corporate treasurer.

Learn more about: Corporate Treasury: What is it all about, and what do you need to know?

The Role of a Corporate Treasurer

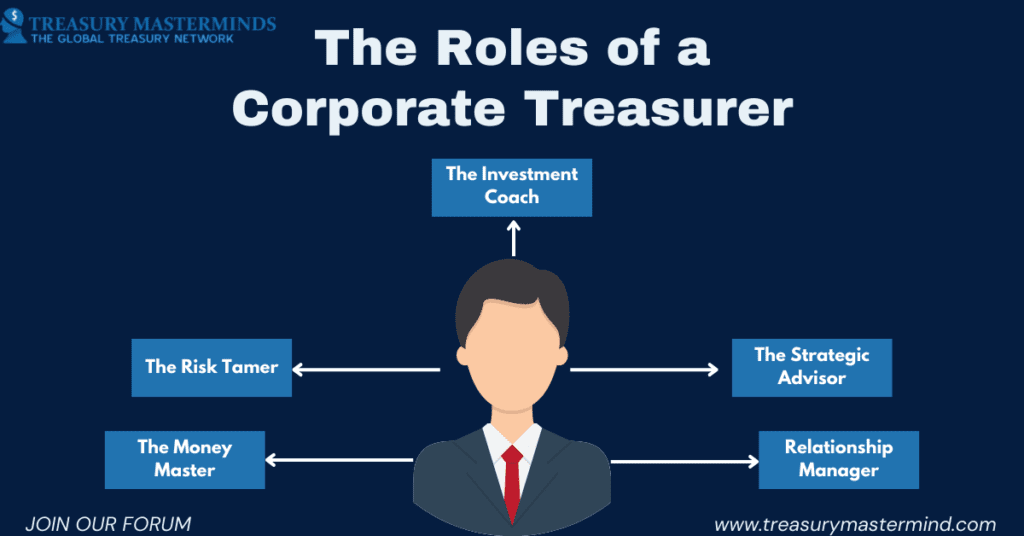

Think of corporate treasurers as:

1. The Money Master

They oversee all cash inflows and outflows, ensuring your business has enough funds to operate smoothly. If your business is experiencing seasonal fluctuations in sales, they would forecast these cash flow changes and ensure that funds are allocated efficiently to cover periods of low revenue, perhaps by arranging for a line of credit. Think payroll, payments to vendors, and managing credit lines.

2. The Risk Tamer

They identify and manage financial risks like currency fluctuations, interest rate changes, and market downturns. If your business is exposed to risks like foreign exchange fluctuations, they would implement hedging strategies to protect the business from such financial risks. Strategies that will minimize losses and protect your financial health.

3. The Investment Coach

They make informed decisions about where to invest your surplus cash, ensuring it grows and generates additional income for your business. If your company has excess cash that it wants to invest, the treasurer would analyze various investment options, considering the return on investment and risk factors, to maximize profits while ensuring financial safety.

4. The Strategic Advisor

They provide valuable financial insights and guidance for your business, shaping the overall financial strategy of the company. If your business plans to expand its operations, they would assess different funding options, such as issuing bonds or taking a loan, and choose the most cost-effective method that aligns with your company’s financial strategy

5. Relationship Manager

Your business needs to communicate its financial health to stakeholders. They play a key role in maintaining transparent relationships with investors, creditors, and other stakeholders by providing clear financial information and forecasts.

Why a Corporate Treasurer is Vital for Your Business

Here are some examples of how a corporate treasurer can help your business:

- They leverage their financial expertise to secure favorable loan terms and interest rates, saving your business money.

- They implement strategies like early payment discounts and automated receivables management to improve your cash flow and avoid cash crunches.

- They help you navigate the complexities of international transactions, minimizing losses from currency fluctuations.

- They identify and invest in low-risk, high-return opportunities to generate additional income for your business.

- They create strategies to mitigate risks like market downturns, fraud, and cyberattacks, protecting your business from financial losses.

Having a skilled corporate treasurer is like having a financial GPS for your business. They guide you through the ever-changing financial landscape, ensuring you reach your destination—financial stability and growth.

Remember, the size of your business doesn’t matter. Even small and medium-sized businesses can benefit from the expertise of a corporate treasurer. You can hire a full-time treasurer, outsource the function to a specialized firm, or leverage technology solutions to automate some tasks.

Investing in a corporate treasurer is an investment in your business’s future. It’s like adding a safety net and a growth engine to your financial ship. So, set sail with confidence, knowing your financial well-being is in the hands of a capable captain.

Join our Treasury Community

Treasury Masterminds is a community of professionals working in treasury management or those interested in learning more about various topics related to treasury management, including cash management, foreign exchange management, and payments. To register and connect with Treasury professionals, click [HERE] or fill out the form below to get more information.

Good one.