Introduction

In “Treasury as a Strategic Function”, we explained why Treasury matters to you, the Non-Treasurers. Later articles discussed how operational and strategic treasuries in the chasm offer limited value. Real value-add comes from strategic treasuries that have crossed the chasm.

The previous article mentioned that amounts, cultures, and contexts push treasuries into the chasm. When you and treasury want to take action, you can’t change the underlying business cashflow amounts – they are what they are. Culture and context, on the other hand, can be changed. This article will show how treasuries emerge from the chasm by doing precisely that. This solution may seem unconventional – it’s rarely mentioned in standard articles and textbooks – but as the problem isn’t financial, neither is the solution. The issue stems from people in and outside of treasury, so change must focus on them.

Note for non-Treasurers: As an organisation insider, you can request and support treasury’s evolution into a strategic function valuable to everyone, especially during crises. But, understanding the relevant context and cultural elements is crucial for formulating practical next steps. For suppliers, it’s similar; your products and services are tools for operational and tactical treasuries, often sold on price. However, when offered with appropriate technical and soft know-how relevant to each specific client, they become solutions for treasuries that are or want to be more sophisticated. These are sold on value, not price.

These benefits underscore why mastering ‘soft skills’ like culture and context change is vital for all of you.

Types of treasuries

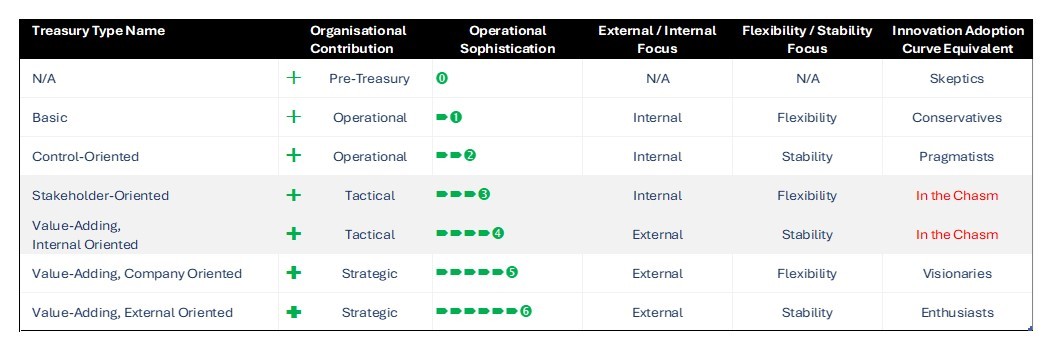

Let’s revisit the different types of treasuries before exploring them in more depth.

While Figure 2 shows each treasury type in a distinct quadrant, all types except the basic treasury build upon each other. They progress layer-by-layer through operational and tactical levels until the function reaches its pinnacle in a few companies like IATA and GE Capital: those with a value-adding, external-oriented organisation. See Figure 3.

Figure 2 highlights the challenge faced by tactical treasuries. As the saying goes, “A servant cannot serve two masters.” These treasuries have conflicting priorities and will never match the effectiveness of a strategic treasury.

Crossing the chasm brings clarity to the purpose of treasury and, therefore, to its ability to effectively deliver material value to the organisation.

Bridging the chasm methods

In this section, we’ll explore examples of three different methods for bridging the treasury chasm. Detailed information is provided in the appendices for those interested in the general frameworks applicable to any organisation.

Method 1: Out of sight, out of mind

This method was the first I encountered in my professional career, though I didn’t realise it followed a successful standard framework at that time.

While working for IBM Europe, we faced a challenge: some subsidiaries were borrowing while others were lending, but not to each other. This inefficiency cost the company money and exposed the group to material risks if one of the cash-holding banks were to fail. However, IBM’s decentralised structure meant the head office couldn’t force subsidiaries to lend to each other.

Our solution? Create a function with a different culture in a new context:

To change the context, we:

- Set up an internal bank, a new subsidiary offering financial services to other group companies.

- Equipped it with advanced technology and implemented policies and processes that allowed operational staff to react in real-time within company-approved rules.

- Installed robust internal controls.

To change the culture, we:

- Located the new entity in Ireland, separate from existing treasury operations in France and the UK.

- Isolated staff and management from other IBM treasury personnel to avoid the internal and control orientations.

- Recruited external financial market risk management experts from banks and empowered them to manage controlled risks.

- Ensured subsidiaries retained the right to deal with local banks, forcing the new entity’s staff to be proactive, external and customer-focused to be successful.

The internal bank started with lending and borrowing only. Voluntary participation meant subsidiaries saw it as an opportunity, not a threat. Even in the first year, they gave 95% of their business to the new entity. The function grew rapidly, taking over customer financing activities and delivering improved services. It became a successful value-adding, company-oriented function.

I learnt a crucial lesson later on, which I now pass on to you: implementing and creating a new culture isn’t enough. It must be nurtured until firmly embedded both inside and outside the function. In IBM’s case, this wasn’t fully achieved, partly due to Lou Gerstner’s top-to-bottom restructuring in the 1990s. As a result, the function arguably went back into the chasm. It was better than before but didn’t reach its full potential.

The general framework for Method 1 is in Appendix 1 of the Treasury for Non-Treasurers (Appendices) article.

Method 2: Leadership led

To keep the article concise, I’ll provide fewer details for this and the following method. The underlying principle in all methods is the same: change the culture to an external focus. While Method 1 creates a new environment with a voluntary focus on external customers, Method 2 establishes an environment where delivering what’s wanted externally is mandatory.

Method 2 is straightforward:

- Senior management decides that treasury must become a strategic, material value-adding function. This decision can stem from:

- Company strategic reasons, such as matching competitors’ financing offerings.

- Leveraging a financial asset, as seen with Tesco and Tesco Bank.

- Visionary leadership, as illustrated in this method’s example.

2. Senior staff lacking the necessary technical skills or attitudes are replaced with people with the right skills and mentality.

3. Junior staff must adapt quickly or move on.

Example: The ABB Merger

When Asea and Brown Boveri merged in 1987, CEO Percy Barnevik aimed to create a “federation of national companies” supported by global “free-standing service centres”. He sought staff with “exceptionally open minds… who don’t passively accept it when somebody says ‘you can’t do that’” (Harvard Business Review). One of these free-standing service centres was a new financial services function.

This structural and cultural shift shocked the previous Swedish and Swiss company cultures. Many employees lost their jobs and were replaced. New hires in treasury and financial services brought a banking mentality, serving both internal and external customers. Having worked with their financial services division in Asia from 1995 to 2000, I observed that their treasury centres (internal banks) were often indistinguishable from external banks.

The transformation succeeded. ABB’s Treasury was considered world-class until the early 2000s when they faced a company-wide black swan event. They still maintain an impressive treasury function today.

It’s literally that simple.

For the general framework of Method 2, see Appendix 2 in the Treasury for Non-Treasurers (Appendices) article.

Method 3: Treasury-led

This third method is more niche. While I haven’t seen it used in treasuries, I include it here as it could be appropriate in certain circumstances and potentially deliver more value than the other methods if implemented successfully.

This method applies to companies that allocate time to employees to work on side projects. Examples include:

· 3M

· Atlassian

· Apple

· The BBC

· Intuit

Amongst others.

Though the number of companies this method applies to may be small, it’s worth including as it offers significant advantages over the previous two management-led ones. In these cases:

- Management can educate their staff and focus them on resolving strategic issues and taking advantage of new opportunities, thereby raising their awareness of what’s happening in the organisation as a whole.

- Management can steer treasury personnel towards working with outside functions, making them external-focused.

- Treasury personnel can address small but essential infrastructural problems often overlooked in strategic initiatives, improving all aspects of treasury, whether related to internal, external, flexibility or control aspects.

- It boosts morale.

As Figure 6 illustrates, all quadrants benefit.

The primary challenge here isn’t incentivising the staff but ensuring that management encourages and supports them, initially and consistently, over time.

The general framework for Method 3 is in Appendix 3 of the Treasury for Non-Treasurers (Appendices) article.

Conclusion

This article focused on solving one critical problem: crossing the chasm to evolve treasury functions.

Throughout the series, we’ve discussed various types of treasuries at a high level and their value to organisations. We’ve identified the chasm and suggested ways to cross it. However, we’ve not yet investigated the specific activities treasuries can and should carry out at higher levels of sophistication. It’s time to examine these level-by-level activities to help you identify what is relevant in your and others’ organisations’ treasuries. There’s much exciting material to cover.

We established that the primary priority of treasury is to keep the organisation solvent. Also, beyond the chasm, effective solvency management serves as an insurance policy against black swan events and enhances the company’s results at the same time. These are desirable objectives. Therefore, the first of the next articles will focus on solvency management activities.

Next article: Sophistication in Solvency Management

Previous articles in the Treasury for Non-Treasurers series:

Join our Treasury Community

Treasury Masterminds is a community of professionals working in treasury management or those interested in learning more about various topics related to Treasury management, including cash management, foreign exchange management, and payments. To register and connect with Treasury professionals, click [HERE] or fill out the form below to get more information.