Introduction

We left off last week talking about the ‘The Chasm’ and saying that many treasuries end up in it. We also noted that non-treasury stakeholders won’t get material value-add unless they deal with a treasury that has crossed the chasm. It’s, therefore, worth understanding what it is and how to get out of it. And how non-treasurers can help.

This part of ‘Crossing the Chasm’ explains the chasm. We will review practical ways to cross it next week.

Who is in the chasm?

There is no specific revenue tell for companies in the chasm. A company with $ 250 m revenue with a treasury can be a control-oriented treasury not in the chasm or in a stakeholder-oriented one in the chasm. A multi-billion-dollar revenue company can have a treasury that is anything from control-oriented to value-adding and externally focused, so anything from operational to strategic, outside the chasm, or tactical. Many factors are at play, and we will talk about them here.

What causes the chasm?

In a few words, it’s amount, culture and context.

Amount

An organisation with a low turnover doesn’t generate enough cashflows in numbers of transactions and or values. It can’t cost-justify a bigger, more sophisticated treasury.

Culture

Treasury has a culture. It is within finance, which has a different culture. That’s within a company with yet another culture. Other functions with different cultures surround it, some more important than others, such as procurement in a company with large purchasing requirements or HR in one looking after talented and rare employees. Plus, any of these can have dominant individuals within them with their own background cultures and personalities.

Geographical aspects of culture

Consider the following: If a company is headquartered and senior management is in and from a risk-averse culture, are the board and C-suite likely to allow the treasury to cross the chasm and start taking financial risks? Even in a case where the CFO and Treasurer are from low-risk-aversion cultures? It’s not likely. Nor if it’s the other way round. A high-risk-aversion treasurer will not support crossing the chasm no matter if the CFO or board might be open to it. So, to bridge the chasm, what’s needed is a major culture change.

And that’s something no treasurer I’ve met is trained to lead. However, that training, or support from people with that training, is exactly what’s needed if a company wants to cross the chasm and go from being operational and tactical to strategic.

“What gets measured gets managed”, Peter Drucker. This is an excellent time to say that cultural factors, including risk aversion, have been quantified and can be compared to each other in a culture change program. See Image 1 below. Quantification allows culture change planners to be more exact in how to structure successful culture-change programs, so this information is invaluable:

Organisational Culture

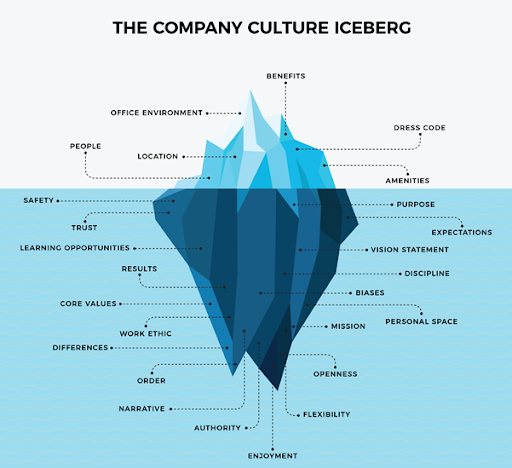

Culture is not all about nationality. It’s about organisational culture as well. And let’s not reinvent the wheel here. We’ll use the ‘Iceberg Model of Culture’ created by Edward T Hall in 1976 and shown in Image 2:

Again, these conscious and unconscious cultural aspects are different at organisation, finance function, treasury itself, and for all other material stakeholder functions. It’s complex.

But, “What gets measured gets managed” again: Quantitative ways to measure corporate culture exist. The best known, now over 40 years old, is the ‘Competing Values Framework’ by Quinn and Rohrbaugh. In the interests of brevity, I won’t get into it here, but please get in touch if you want more details.

Simplifying and Concentrating on the Key Elements of Culture

Clearly, there’s too much to analyse to decide whether and how to change in a practical way. So, although we should remember the big picture for any individual company, we can simplify. I have found from my work that, in most instances, the following are most important:

1. The geographical culture of the company

2. The geographical culture of the essential stakeholder functions

3. The geographical culture of the key personalities, which, for treasury, always includes but is not exclusive to the CFO and Treasurer

4. How each external partner (you, the non-Treasurers) perceives time compared to treasurers (more on this in a moment)

5. How each external partner uses language (again, more on this in a moment)

6. The organisational structures in both treasury and the partner functions

7. The KPIs and bonus systems

The first three are easy to understand from the paragraphs above. The following three, though, are thought-provoking:

Time perception:

The easiest way to describe this is by providing an example.

Accounting, FP&A, and tax get, analyse and use information at month-, quarter-, and year-end. This is so normal that it’s taken for granted. It’s embedded in the core values of the finance functions.

On the other hand, treasury works with financial markets, where rates move constantly. Their perception of time, embedded in their core values, is different.

As a result of the differences in perceptions about time, accounting has problems understanding why waiting for information relating to cashflows to be added to systems at a convenient time within the month is a problem for treasury, who need it as soon as possible. The same is true with errors that will, in their minds, be corrected at month- or quarter-end or even after. It’s not a problem for the rest of finance, why is it for treasury? This time perception difference causes tension and prevents them working together to evolve from tactical to strategic.

Other functions have their own embedded, unconscious perceptions of time. The more functions there are, the more difficult it is to achieve mutual understanding. But, it’s vital to understand there’s no malice between departments not being aligned or moving not fast enough or too fast. Each function must understand the time perception of the other and what’s important to each, to optimise how they work together.

Language:

The use of language is also a subconscious, deeply embedded part of cultures and subcultures. Using the finance function as an example, once again, a ‘cashflow forecast’ in FP&A terms is not the same as a ‘cashflow forecast’ for a treasurer. Both functions use identical words to describe two different things. As each language is embedded deeply within them, there’s, at best, a lack of understanding of nuances and vitally important implications, and, at worst, total misunderstanding.

Which brings us to the third point:

Organisational Structure:

In the last article, we talked about the challenging jobs specialists have in treasury, liaising between their function and other departments. The roles are challenging, but they’re better than having partners in different functions talking to each other as an aside to their primary job. Some people are excellent in multi-disciplinary multi-tasking. Most are not. Successful long-term cooperation occurs when both sides have ‘translators’, whose only job is to liaise between their functions’ operational teams with external stakeholders.

“It takes two to tango!”

KPIs and bonuses

I hope this last item, key performance indicators (KPIs) and bonuses, needs little explanation. When the going gets tough, incentives matter. Bonuses may be monetary or not. They may be necessary for people to afford and enjoy the good things in life, or as a score to measure success against others. It doesn’t matter. If KPIs and bonus structures are not aligned so that both are incentivised to work together, cooperation will be patchy, and treasury and the other functions involved will not get out of the chasm.

Context

Again, there’s context external to the company, context within finance, context within treasury and context between treasury and all relevant important stakeholders’ functions. If the company is going through hard times and has low profitability, will it want to add risks? No. Will a new, non-core venture be contemplated if the company is in a high-growth mode and everyone’s working to cope with that growth? Not likely. If a new organisation-wide system is being implemented, or IT doesn’t have the resources to handle the implementation of specialist treasury systems, will it happen? Again, not likely.

Considerations of context include:

· Negotiating strengths of participants in a transaction or transfer of information

· Potential replacement or bypassing of one of organisations, functions or people in the same or different organisations

· Rivalry and politics

· Political or policy and strategy change, which can affect some but not all functions

· Economic factors, including profitability, as mentioned above

· Social factors

· Technological capabilities, outsourcing, interconnectivity, validity of data passing through the systems and ‘black box’ issues

· Geographic spread of operations, including centralised operations providing services to organisations in multiple locations, for example, shared services, regional treasury centres

· Accounting standards, legal and tax factors

· Environmental factors

This last one is crucial. If anything concerning or even just time-consuming is happening to the key decision-makers or the company, a proposal to make a major change in treasury will get nowhere. Examples include talks of mergers, major reorganisations soon to come or underway, relevant management changes and, in general, anything which means personnel won’t have the time or won’t want attention focused on them. Timing is all.

Different considerations are material depending on who the various non-treasury and treasury stakeholders are. In this case, though, simplification is not needed. A frank discussion of relevant facts and sensitivities is enough.

Skills improvement

But that’s not all. Treasury personnel must learn new technical skills to go from passively managing solvency and minimising financial risks to actively managing and optimising them. Governance structures need to be improved to handle risk management that’s now delegated to lower levels within the organisation. Most importantly, professional soft skills must be learnt to make better decisions, communicate effectively and implement successfully. I have seen treasuries where some of these skills are taught but never all, and never in ways appropriate to each person’s level. This lack of teaching applies especially to decision-making, meeting management, mentoring, communication and change management, all of which are crucial to the culture change process and effective business-as-usual afterwards.

Changing culture and context without teaching relevant technical and soft skills is a waste of time. Moving from tactical to strategic means going from efficiency and things only (systems, outsourcing) and adding effectiveness and people to it (experts, managers). People resist change if they are pushed into it. They either change themselves or leave, in which case people with a new and appropriate mentality can replace them, but they take away significant soft knowledge with them. Unless the transition is carefully managed, the culture change from tactical to strategic will fail. But it can be carefully managed. Success is possible.

Conclusion

Many complex and uncontrollable factors push organisations into the chasm, and, at first glance, it seems unrealistic that they can get out of it. A company whose headquarters is in a high risk-aversion country is not going to change that. But getting out of the chasm is not impossible. As said before, I witnessed the transformation at IBM when it set up a strategic Treasury centre. I have seen how Nokia and ABB organised themselves and learnt the history of how and why they did so. There are three practical approaches to cross the chasm, and we will talk about them all next week.

Next article: Crossing of the Chasm, Part II

Previous articles in the Treasury for Non-Treasurers series:

Join our Treasury Community

Treasury Masterminds is a community of professionals working in treasury management or those interested in learning more about various topics related to Treasury management, including cash management, foreign exchange management, and payments. To register and connect with Treasury professionals, click [HERE] or fill out the form below to get more information.